So you moved to Germany and started your new expat life, made the leap into self-employment and started freelancing. Now you’re seeing – or maybe just foreseeing – transactions piling up in your Privatkonto (private account).

A quick online search confirms the legal requirements. As a freelancer or trader, you don’t need to open a separate Geschäftskonto (business account)*. But… should you open a separate business account?

Absolutely. Here’s why.

- Easy, accurate bookkeeping

- Track cash flow – income and expenses

- Effortless invoicing – know when you’re paid

- Your bank might require it

- For work life balance

Also included in this guide:

*Note: You are required by German law to open a separate business account if you operate as a limited liable company (GmbH or UG). If you're starting a GmbH or UG in Germany, the Holvi founder account is for you!

1. Easy, accurate bookkeeping

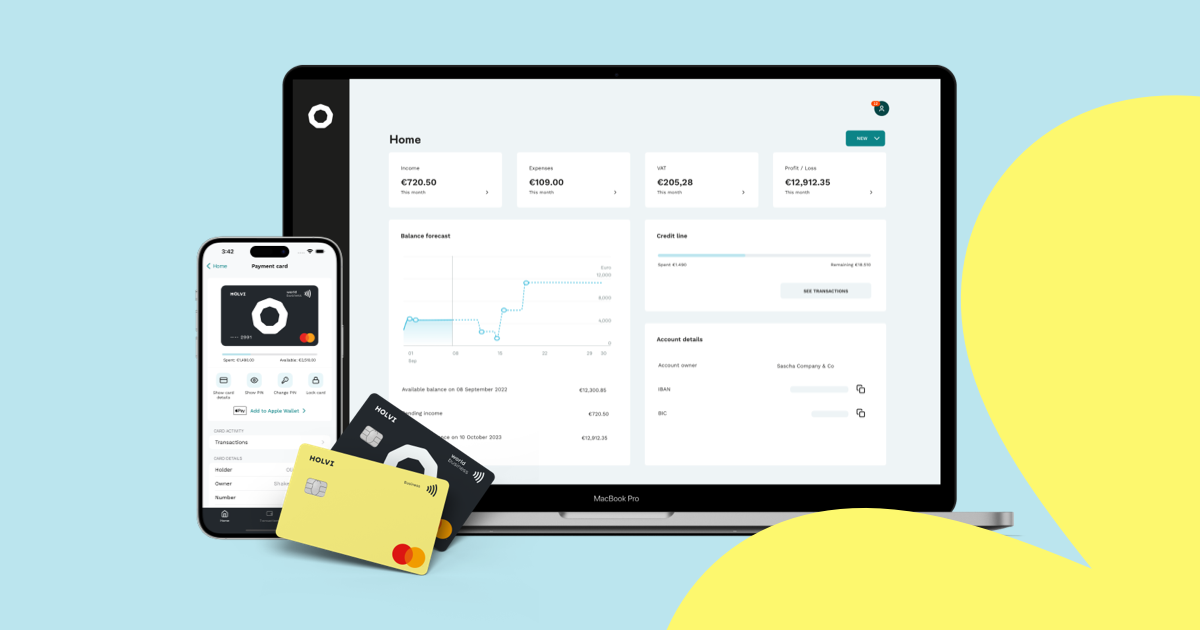

Lots of business accounts offer features aimed at simplifying bookkeeping for self-employed people. Features like:

- Receipt capture – to remind you via notification to snap a photo of your receipt, add notes and attach it to your transaction on the go – then save for easy bookkeeping.

- Categorisation – to filter expenses into relevant categories, helping you keep track of what money goes where.

- VAT calculator – to calculate in real time how much VAT you owe – or what you can claim back!

Smart bookkeeping features will help you keep track of transactions so that when tax season rolls around everything is clear and orderly. This will keep the Finanzamt happy and make life easier on yourself.

Tip – Start your freelancing journey on the right footSeparating your business and personal finances from the start can save you lots of trouble – switching later on requires contacting clients and service providers to switch payments and subscriptions to your new account. Learn more about the Holvi business account. |

2. Track cash flow – income and expenses

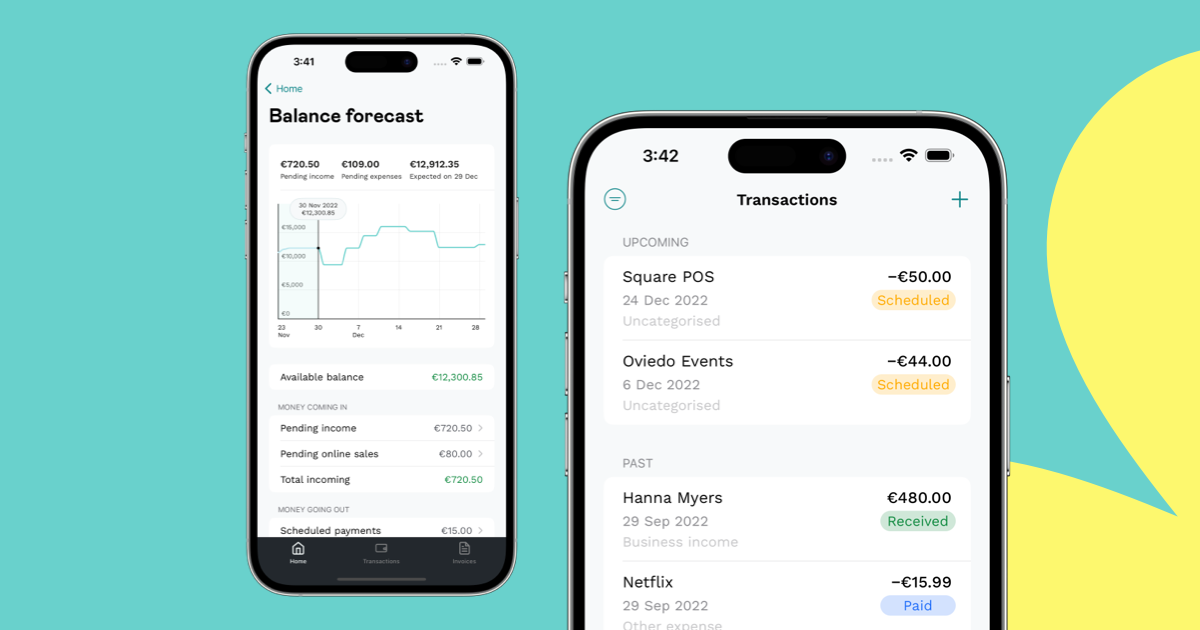

Keep an accurate view of your cash flow. Opening a separate business account guarantees a clearer overview of your business finances – and by extension your personal balance. This helps you avoid overspending, especially in the early stages when you’re just setting up.

Tip – Check your balance forecast regularlyHolvi's balance forecast shows your estimated cash flow based on scheduled payments, like invoices due and payments out – so you can always stay one step ahead of the curve. |

3. Effortless invoicing – know when you’re paid

Tired of compulsively checking your phone to see if that invoice has finally been paid?

Now you can now find business accounts with built-in online invoicing tools designed to take the stress out of invoicing. Because while we all love getting paid, let’s face it, no one likes asking for money – even if we’ve earned it.

Tip – Simplify your invoicing process and get paid fastHolvi's invoicing feature let's you create and send beautiful invoices online. You will get instant notifications on paid invoices – it's as easy as that. |

4. Your bank might require you to open a separate business account

Check your bank’s T&Cs – sorry, you might need to pull out the magnifying glass. Some banks prohibit using your personal account for business purposes. Generally speaking, traditional German banks permit a certain number of business transactions each month. If your monthly business transactions exceed your personal account’s limit, your bank might try to switch you over to a business account, typically with a temporary free trial period.

You should avoid automatically doing your business banking with your personal bank. Instead, invest some research and consider your options. Finding a service that best suits your needs can save you time and money.

5. Find work-life balance

Sometimes it’s easy to get carried away in the dream of your new freelancer lifestyle in Germany. You might momentarily lose track of reality – invoices to send, bills to pay, VAT to calculate.

You have your personal and your professional life – and these should, for your sanity and your business’ success, be kept separate. Yes, there will be days when urgent deadlines mean you work late, infringing briefly into your personal life. But you’ll want to consciously move away from this as your small business grows into a stable and long-term affair. You'll want to find a balance – and a business account is the first step.

What options do I have for choosing a business account?

There are two basic options for choosing a business account in Germany:

- Free (no monthly fee)

- Paid (with monthly fees)

Free business account

A ‘free business account’ may not have monthly fees, but it could still cost you. Instead of a flat fee, you might be charged slightly higher fees for card transactions or other services. Make sure that you understand your needs, like how many monthly transactions you have, or what bookkeeping features you require.

Tip – Start with HolviHolvi Lite has everything you need to get your business up and running – for the price of two oat milk cappuccinos a month. For your peace of mind, here’s our 100% transparent breakdown for Holvi Lite costs in Germany, in English. Or you can find it summarised in an attractive pricing table here. |

Paid business account

The other option is a paid business account. When paying a monthly fee you can typically expect lower transaction costs (for example, lower cash withdrawal). Some extras might also be included, to help you run your business. Look out for the features mentioned above – invoicing and expense management, as well as a business payment card.

A paid business account can turn out to be the cheaper option, especially if used extensively.

Tip – Go Pro with HolviSend unlimited invoices & e-invoices and gain powerful insights into your business’ inner workings – financially speaking – with Holvi Pro. If your needs change you can always adjust your plan. |

What do I need to open a business account?

Here’s some good news! All you need to open a Holvi business account in Germany is:

Guides to verification with HolviYou can find all the technical details on opening a Holvi account here. |

Think about the time and energy that separating your finances will save you – both now and down the line when it’s tax time. Then think back to these 5 factors and ask yourself the question: ‘Would I benefit from opening a separate business account?’

If the answer is yes, consider Holvi.

Want to learn more about freelancing as an expat in Germany?We hope this article helps you know what to look for when choosing a business account in Germany. If you want to explore more expat questions, check out:

|

/6_how_it_works.png?width=477&name=6_how_it_works.png)