Having a separate business account isn't always legally required, but it's a smart move for anyone starting a business. Why? Well, apart from keeping your finances neat and tidy, a business account can help you save on taxes and can serve as a handy tool for managing your business bookkeeping and invoicing. So what's a good business account for you? Worry not, we're here to help you find a fairly priced business account, so you can start on the right financial foot!

In this article, we will guide you through the main pricing criteria for business accounts:

- Choosing an account that supports your business form

- Opening fees

- Free business accounts and excess transaction fees

- Monthly fees: Online business accounts vs. traditional banks

- Our tip: Account fees are tax-deducted

- Is Holvi right for you?

Choose an account that supports your business form

To begin, regardless of price, the first step to picking your business account is creating a list of your options. Not all business account providers will have accounts for every business form. This becomes especially apparent for the self-employed and small business owners who might find themselves facing more challenges in finding suitable business account options. The key? Vigilance, my friend. Dive into it, dig around, and make sure the account you're eyeing fits with your business form. It's all about finding the perfect match in this big world of business accounts! Being vigilant in the early stages can pave the way for a smoother financial process as your business grows.

Opening fees

Once you've narrowed down your options it's time to compare them. Let's start at the beginning! When you're looking at business accounts, there is one initial criterion that can help narrow down your choice right from the get-go: opening fees. Not all business accounts will have opening fees but others might ask for an arm and a leg. Self-employed should opt for an account that isn't associated with steep opening fees and instead, they should focus on finding an account that allows them the freedom to close the account if necessary.

Free business accounts and excess transaction fees

Free business accounts? Yup you heared me, they're a thing. No opening fees, no monthly charges - sounds like a dream, right? But hold your horses. Exercising caution is pretty important when considering free business accounts because they can have very steep transaction fees. Free business accounts are best suited for business owners who don't have many business transactions, have an in-depth understanding of their business operations, and have the time to monitor the transaction charges. Free business accounts often start free, but the transaction fees can rise quickly, making what seemed cost-effective, surprisingly expensive. Therefore, if you opt for a free business account make sure to keep a good eye on your monthly bill.

Monthly fees – Online business account vs. traditional banks

Instead of rolling the dice with potential hefty transaction fees on a free business account, a smarter move might be to consider a business account that offers you more features for a fixed monthly fee. These kinds of business accounts often offer you helpful banking features, like bookkeeping assistance and handy invoicing tools. Here's a tip: online business accounts usually offer a bunch of features for a reasonable monthly price because they don't have to worry about maintaining physical branches. But, if you heavily depend on cash, you might have to pay more for a business account at a traditional bank. Traditional banks usually charge more because they have to cover the costs of those brick-and-mortar branches for cash deposits and pickups. Just something to keep in mind!

Our tip: Account fees are tax-deductible

Here's a nifty tip: remember those monthly fees you pay for your business account? Yep, they're often tax deductible! But, and it's a big but, you should double-check this with a tax advisor. Making sure you've got all your ducks in a row when it comes to taxes is important. So, while that deduction sounds sweet, always better to confirm and avoid any tax-time surprises!

Is Holvi right for you?

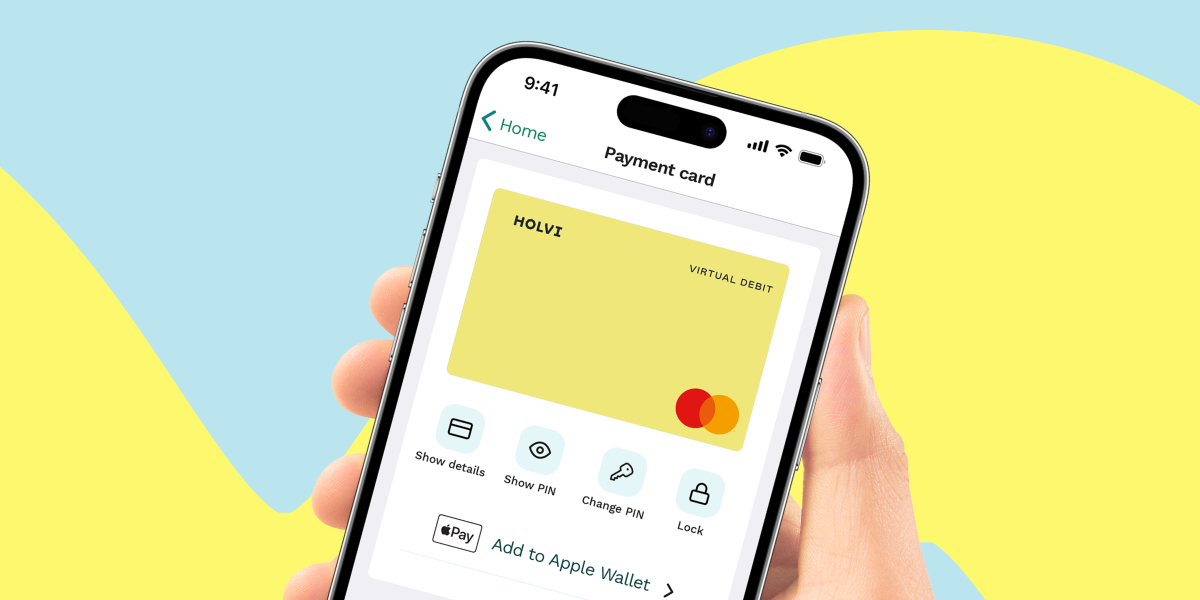

If you're self-employed or a small business owner, then Holvi might be for you. For a fixed monthly fee starting at just 9 Euro, Holvi has smart bookkeeping features like a VAT calculator, receipt scanning and invoicing features. On top of that with Holvi you can easily open your own online store without any programming knowledge. Holvi's online business account is easy to open and cheaper than the business accounts offered by some traditional banks. Learn more about the Holvi business account here.

Summary

All right, let's break it down! First things first, when you first start looking for your business account, make sure to find accounts that are made for your business form – there's no one-size-fits-all here. Next up, keep an eye on the opening fees. Also, be careful around free business accounts – they might seem like a steal at first, but they often come with surprise transaction fees. Our tip: If you're not dependent on cash then an online business account with a fixed monthly price could be the right option for you. It gives you a bang for your buck with many helpful banking features.

/6_how_it_works.png?width=477&name=6_how_it_works.png)