'Can I sponsor a Finnish ski team and write it off as a business expense for marketing purposes?'

Absolutely.

'What about car expenses, can I deduct those too?'

Depends, but yes.

As a small business owner, you know that every cent counts. Tax deductions are a way to recoup money spent on necessary business expenses throughout the year. Lower costs means higher profits. So…

What else counts as a tax-deductible expense?

We'll answer that – but first, a note on receiptsKeeping expense receipts is a must when applying for any kind of tax deductions. In Finland, you’ll need to hold onto those receipts for 6 years. Holvi lets you snap, sort and save receipts digitally, and add notes for bookkeeping records – so you always stay tax-ready. |

Self-employed tax deductions

- Office supplies, tools and small purchases

- Software and online services

- Marketing and advertising costs

- Entertainment expenses

- Office and home office expenses

- Car expenses

- Workwear

- Professional journals, newspapers and subscriptions

- YEL (self-employed pension insurance contributions)

- Accident insurance

- Membership fees

- Interest payments

- Learning and training costs

- Licence fees

- Promotional gifts

- Travel and commuting expenses

- Negotiation expenses

- Research expenses

- Sponsorship

- Occupational healthcare

Welcome to Foreign in Finland!Your tailor-made selection of articles on self-employment in Finland, for non-Finnish speakers like you! Subscribe now for updates – straight from the heart of Holvi. ✔️ 100% English ✔️ Up-to-date, accurate info ✔️ For the boldly self-employed |

Office supplies, tools and small purchases

You can deduct a range of office supplies, including all the usual things like pens, chairs and snowglobe paperweights depicting a snowy Lapland scene. There are two ways to do this in Finland.

- If the expected life of the equipment is three years or less, it can be deducted as a one-off expense. This applies to everyday necessities such as pens, notebooks, printer paper, etc.

- If the expected life is longer than three years – for example, printers, monitors or office furniture – you can deduct these as ‘small purchases’. If the cost does not exceed €850, it can still be deducted as a one-off expense.

Small purchases can be deducted up to a value of €2,500 per tax year. Anything over this is deducted as depreciation, i.e., the purchase price is spread over the years your business uses the equipment.

What is depreciation?‘Depreciation is an accounting method of allocating the cost of a tangible or physical asset over its useful life or life expectancy. Depreciation represents how much of an asset's value has been used up. Depreciating assets helps companies earn revenue from an asset while expensing a portion of its cost each year the asset is in use. If not taken into account, it can greatly affect profits.’ – Investopedia |

Software and online services

You can deduct software and online services costs as they relate to your business – for example, server and domain fees, VPNs and SaaS (software as a service) subscriptions.

You can also deduct business-related phone and internet costs, although the distinction between business and private use isn’t always clear-cut.

Marketing and advertising expenses

Marketing expenses, company magazines/brochures and promotional events are fully deductible.

Marketing can also include:

- Digital marketing bought through an advertising agency

- Advertising space purchased from a sports team or athlete is also deductible

- The cost of advertising in business-related magazines, but not political magazines

An advertising event is by nature an open event to which any potential customers have access. For example, a trade fair is a good example of a deductible promotional event.

Marketing events aimed at reeling in specific target groups are also deductible. But note, some restrictions apply: catering can only be at ‘lunch level’(meaning nothing too fancy) and any activity that continues after the event is generally classified as an entertainment expense. See more on Vero’s page here.

Entertainment expenses

'Entertainment expenses are those incurred by clients as a result of hospitality or other forms of courtesy.' – Vero

In practice, this usually covers expenses incurred by travel, restaurant, catering, and renting venues. Entertainment expenses are always incurred outside the company – internal company parties don’t count as entertainment expenses.

A company can deduct 50% of its entertainment expenses for tax purposes. However, please note that VAT on entertainment expenses is not deductible.

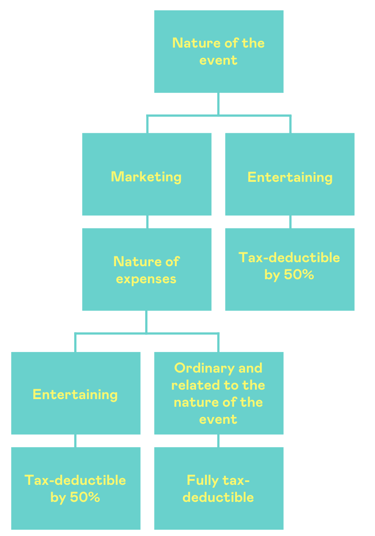

Figure 1. How to deduct marketing vs. entertainment expenses

Home office deduction

If you work from home, you’re entitled to tax deductions. Simple as that.

The easiest way to register home office expenses is to claim a so-called ‘standard workspace deduction’. This applies even if you don’t have a separate workspace – i.e., if, like so many others this year, you worked from the dining table.

Home office deduction is determined by the percentage of days you worked remotely.

The home office deduction partially covers rent, lighting, electricity, heating and cleaning, as well as furniture, such as desks and work chairs. This means that you can’t deduct furniture costs separately, as per our section above.

‘In order to claim the deduction, you have to go to MyTax and tick the box for how often you have worked from home last year: more than half the time, less than that, or just occasionally’ – Minna Palomäki, Senior Tax Specialist at Vero

How to calculate home office deductions 2021

If you worked full-time from home for more than half of last year, you’re entitled to a standard workspace deduction of €900. On the other hand, if you worked remotely for less than half of your workdays, you can deduct €450. If you only worked from home occasionally, your standard deduction is €225.

If both you and your partner worked from home, you can both claim the standard workspace deduction according to the percentage of days you worked remotely.

Car expenses

For some self-employed people, a car is the lifeblood of their business. So it comes as a relief that business-related car expenses are deductible. Deductions can either be made in your accounts or as an additional deduction (kilometre allowance).

The most important question to ask yourself when deducting car expenses is what proportion of your driving is business-related. To answer this, you’ll need to keep a logbook.

If under 50% of your car usage is business-related, your car is considered a personal vehicle. In this case, the simplest way to claim car expenses is to deduct a kilometre allowance (€0.44/km in 2021) for the total distance driven for purposes.

If over 50% of your car usage is business-related, your car is considered a company vehicle. In this case, you’ll record car-related expenses in your company’s accounts. Car-related expenses include:

- Fuel

- Maintenance

- Insurance

You can read more about tax deductions on vehicles in our Foreign in Finland article, Kilometre allowance in 2021.

Finnish tax authorities are picky about who’s allowed to deduct VAT on the purchase, use and sale of vehicles. We cover these questions in the who pays VAT on mileage and car expenses section of our article, but it’s always wise to confirm individual situations with Vero or an accountant.

Workwear

You can provide yourself and any employees with protective clothing or work uniforms, tax-free. If clothing can be worn outside of work, it loses its tax-free status.

Unfortunately, even if your job requires you to wear formal business wear, this does not qualify for tax exemption. In this respect, workwear exemptions in Finland are somewhat inconsistent across industries.

These are the conditions for tax-exempt workwear:

- The clothing is used only at the workplace

- As such, it is of the nature that it can’t be reasonably worn in leisure time

- The clothing bears the employer's branding

- The clothing is owned by the employer (although this isn’t always required)

Professional journals, newspapers and subscriptions

Do you subscribe to professional magazines in your field? Even if these are sent to your home address, you can deduct these as expenses in your taxes. Newspapers are also deductible, but subscriptions must be taken out from your business address.

Self-employed person’s pension contributions (YEL)

YES! You can deduct YEL contributions.

You can deduct YEL contributions for tax purposes for your company, you or your spouse. Make sure to optimise this so the entity with the highest tax rate deducts contributions.

Accident insurance

If you have employees, you’ll usually need to take out accident insurance for them (for full details, go here). If you’re self-employed and work alone, accident insurance is optional. In Finland, a separate accident insurance policy replaces Occupational Accident and Disease Insurance contributions, which are deducted from an employee’s wages. It’s the norm for employees – and you could be seriously disadvantaged if anything untoward happens.

Best of all, you can deduct the premiums from your tax bill.

Membership fees

You can deduct membership fees for organisations as they relate to your work. Membership fees for recreational organisations are not deductible – for example, a membership to the Finnish Kite Flying Society can’t be written off as a business expense, unless you fly kites for a living.

Interest payments

Tax-deductible interest is a borrowing expense that the self-employed can claim on their annual tax return to reduce taxable income. The following types of interest are generally tax deductible:

Other potentially deductible interest expenses include interest on student loans and on some business loans, including business credit cards. Remember, it’s always best to ask your accountant if you’re unsure about your particular case.

Learning and training costs

Maintaining and enhancing your skills takes work, and might require training. Such training expenses are deductible, but expenses to help launch you into a new line of work are not.

In other words, upskilling is deductible. Score!

This means you can deduct work-related training courses and books/learning resources from your taxable income.

How about some tax tips? Read also: |

Licence fees

If you need business permits, these are deductible. For example, if your work requires a transport licence, you can deduct this from your tax bill.

Promotional gifts

Traditional promo gifts – like branded pens, mugs and notebooks – are deductible. The VAT liable price of a gift can’t exceed €35 and must be purchased to be given to an undetermined number of people. In other words,

Sorry, you can’t write off that extravagant Christmas gift for your favourite client.

Be careful with alcoholic gifts, though. These are considered entertainment expenses, and so are 50% tax deductible but not liable for VAT deduction.

Promo pro tipIf a normal promotional gift is given as an anniversary gift, it doesn’t count as an entertainment expense. |

Travel expenses and commuting expenses

Work-related travel expenses are fully deductible. This includes travel for marketing, delivery and contract negotiations – not normal home-to-work travel.

Find out all you need to know about deductions on travel expenses and daily allowance for the self-employed in 2021 in our Foreign in Finland article.

Negotiation expenses

Negotiation costs include expenses that arise in connection with ‘negotiations’ (i.e., interactions) between you and experts / the authorities. For example, an audit with the tax authorities – eek! Sounds like a headache. On the plus side, these expenses are fully deductible.

Vero stipulates that catering must be limited – for example, refreshments and coffee. No bribing the tax auditors with Michelin-star catering!

Research expenses

Do you need to invest in research to develop your business? Finland demonstrably values hard work and knowledge:

All research expenses are tax deductible.

This includes staff salaries, materials, research supplies and equipment.

Sponsorship

Want to sponsor a local ski jumping team? You can deduct the cost of sponsorship as a marketing and advertising expense. If the sponsorship agreement includes VAT, this is also deductible.

But note, if you sponsor the leisure activities of people in your immediate circle without a clear business purpose, the tax authorities might consider it a disguised investment.

Main takeaway: always sponsor for marketing purposes, not personal gain.

Occupational health

If you’re self-employed, you can choose to arrange occupational health coverage for yourself. Kela can reimburse part of the coverage.

Kela provides reimbursement for self-employed people insured under the Self-Employed Persons' Pensions Act( YEL).

Reimbursement criteria

To access occupational health services, you’ll need to agree on a healthcare plan with an external service provider – such as a public medical centre (in Helsinki, ‘Health Stations’) or private medical centre. Kela reimburses a maximum amount of around €150 per person. The remaining costs are tax deductible, provided you have a valid:

- Agreement on occupational healthcare

- Plan for implementing, developing and monitoring occupational healthcare

- Workplace survey

What is a workplace survey? From Kela’s website: ‘Occupational healthcare is based on a workplace survey in which the service provider examines the work practices and workplace conditions and evaluates their health impact.’

For more details, visit Kela’s page for self-employed occupational healthcare.

When it comes to tax deductions, accountants are friends

Tax deductions for the self-employed aren’t always clear cut. In a long and successful career you’re bound to come across fringe cases where you’re not 100% clear if an expense is deductible. When this happens, you should always check with an accountant.

Holvi Pro offers all the tools to run your business effortlessly. You can invite your accountant directly to your account, and bypass tax stress completely.

Looking for a new business accountant? Check out Holvi Zen – but note, this service is currently only offered to sole traders in Finnish. English is coming soon!

/6_how_it_works.png?width=477&name=6_how_it_works.png)